Save using your favorite stations.

Fuel smarter with the Engaged Financial Fuel Card

Make vehicle purchases anywhere Visa and Mastercard is accepted. Enjoy no transaction, setup, software, or maintenance fees.

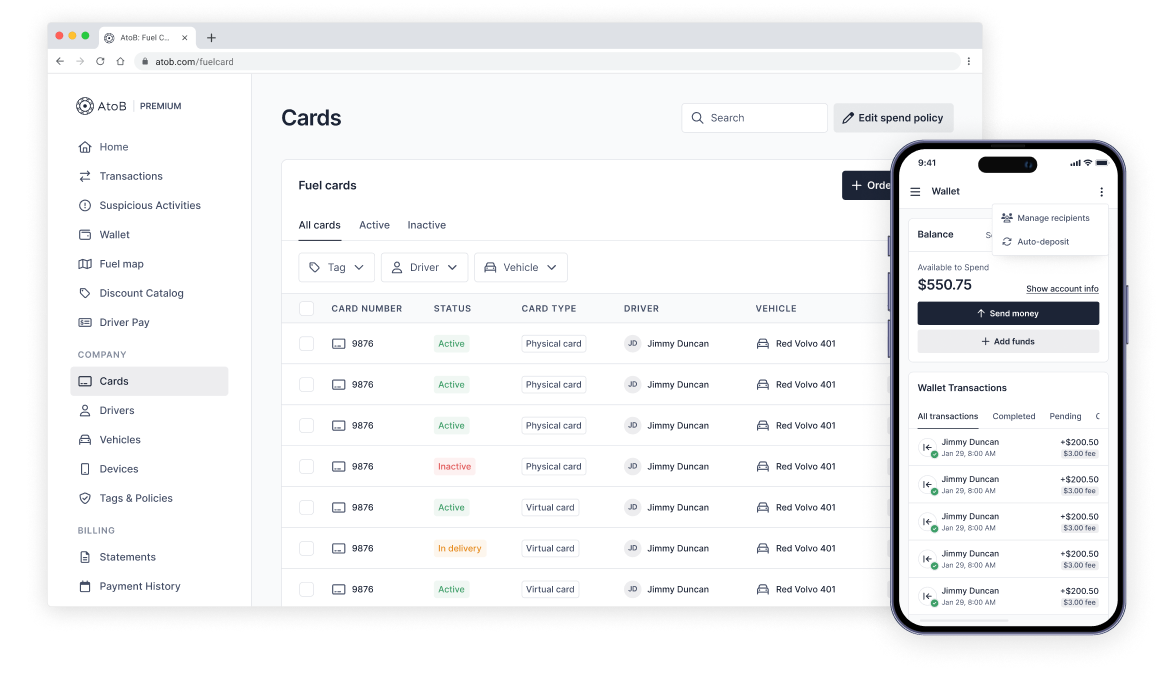

When modern time meets real-time

Manage your cash flow from anywhere: receive factored funds and instantly transfer to anyone. Track fuel spend, view real-time fuel prices, and monitor transactions, all from one easy-to-use dashboard.

Save time, money, and headaches

The Engaged Financial Fuel Card and Wallet team provides features to give you peace of mind and let you focus on keeping your business moving.

98% of applicants are approved

Applying has no negative impact on your credit score. Qualify for a weekly credit line or get a pre-funded card that helps you build.

Purchase fuel anywhere, nationwide

Use your Engaged Financial Fuel Card at truckstops nationwide. That’s 99% of stations, including mom n’ pop shops!

Build business credit with every purchase

Each purchase on the Engaged Financial Fuel Card works to build your credit score to help you qualify for more credit in the future.

Security features to bullet-proof your fleet

Protect against fraud with spending limits, merchant whitelist/blacklist, and transactions monitoring in real-time.

24x7, 365 Support

We offer customer service via phone, chat, and email with an average response time of 29 seconds.

Frequently Asked Questions

How much can I save with a fuel card?

The Engaged Financial Fuel Discount Network offers discounts up to $2.00 off per gallon on truck diesel at stations like TA, Petro, TA Express, 7-Eleven, Speedway, RaceTrac, and more.

Can fuel cards build credit?

Not all fuel cards build credit, but ours does - even on prepaid cards! We regularly report to Experian because we know how important it is for small businesses to build credit.

What can you purchase with a fuel card?

With our fuel card, you can save on the gas you purchase, without limits on discounts and rewards. You can also opt to use our card on other vehicle-related expenses in addition to fuel expenses, including maintenance, tolls, tires, and more.

What is the point of a fuel card?

Our fuel card exists to protect your business, save you money, and provide you with all level 3 fueling data needed to run your fleet - including fuel type and volume for each transaction. The Engaged Financial Fuel Card is accepted nationwide, so you can make vehicle related purchases virtually everywhere and comes with some of the best discounts in the industry, without any limits on how much you can save.

Where can a fuel card be used?

The Engaged Financial Card can be used on vehicle related expenses anywhere, covering just about every fuel station nationwide.

Can I set driver specific spend limits on my fleet of multiple drivers?

Yes! Fleet managers and operations teams have the controls to easily set card limits for groups of cards, contractors, or team members.

Do I need a business credit score to sign up for the Engaged Financial Fuel Card?

No – we just need your EIN, driver's license, and proof of business revenue from the past three months.

What is the Engaged Financial Wallet?

Where can I access my Engaged Financial Wallet?

- Engaged Financial Fuel Card & Wallet Portal: app.atob.com

- AtoB Mobile App: Available on the Apple App Store and Google Play Store.